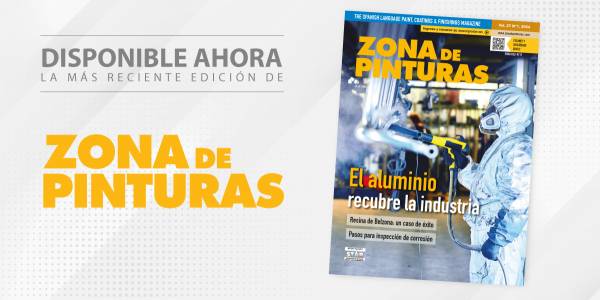

by Vanesa Restrepo

With a per capita consumption of three liters of paint and a production of 1,130 million liters during the previous year, the Brazilian paint industry is consolidated as the largest in the region and, therefore, the most attractive for new investors.

With a per capita consumption of three liters of paint and a production of 1,130 million liters during the previous year, the Brazilian paint industry is consolidated as the largest in the region and, therefore, the most attractive for new investors.

Even though these numbers are positive, the industry recorded negative results during the first quarter. But the situation is not surprising, especially if one takes into account the global economic context, in which consumption and access to credit were reduced, generating a chain reaction; that is, decrease in production, reduction of employees, suspension of some plants, among others.

Although annual production is measured in billions of liters, manufacturers only work at 80% of their total capacity, which indicates that there is a productive capacity that can be used to increase the size of the market, once consumer trends normalize.

Dilson Ferreira, executive director of the Brazilian Association of Paints and Coatings, Abrafati, explained the situation experienced by the productive sector in 2008: "Last year we had a very strong growth until October, but with the fall registered in November and December we closed the year with a growth of 8% above the results of 2007".

The previous situation corresponded to the outbreak of the international crisis. The following months had results in red, as calculated by economic experts around the world. "The first tremestre of 2009 (the production and sale of paints) fell compared to 2008 by about 11%. The expectation is that it will begin to have a gradual growth, but still slow, above last year's records," Ferreira said.

As a result of the bad timing, staff cuts have been made in some factories, especially those dedicated to the formulation of original automotive paint and industrial paints, in general. Abrafati estimates that layoffs may be around 200, but maintains that no factory has yet fully closed its doors.

Working to grow

In response to the drop in demand and production, the Brazilian paints and coatings industry has moved its chips in recent days, to weather a situation that, if it continues, could have devastating effects. Therefore, in recent days there has been news of the approval of government plans that seek to encourage consumption and reactivate the flow of credit.

In response to the drop in demand and production, the Brazilian paints and coatings industry has moved its chips in recent days, to weather a situation that, if it continues, could have devastating effects. Therefore, in recent days there has been news of the approval of government plans that seek to encourage consumption and reactivate the flow of credit. Results obtained in the first quarter of 2009 and the shock measures adopted modified the growth projections. At the end of 2008, when the true scope of the global financial problem was not yet known, Brazilian unions and entrepreneurs calculated a growth of close to 2.5% for the industry, based on a GDP calculation of 2%.

Today there is talk of degrowth: "As there was a first quarter with so many losses, we calculate that we will end the year with a fall of 2%. All this was flattered by the measures that were taken and that basically consist of a tax reduction for paints, a reduction in interest rates that is an aid for the purchase of durable goods such as houses, cars, appliances and by the government's program of housing incentives.

Manufacturers agree with Abrafati's approaches. "The crisis seems to finally begin to subside, after a first quarter with a 12% drop in the market compared to the same period of the previous year. The reduction of IPI (Tax on industrialized products), the reactivation of the stock markets, the fall of the dollar and the drop in interest rates should contribute to the market improving in the second quarter of the year," said André Niero, sales director of Akzo Nobel Decorative Paintings Brazil.

The executive refers to the economic stimulus project recently announced by the Minister of Finance of that country, Guido Mantega. The plan contemplates an elimination of the IPI for vehicles with 1.0 power engines that had a tax burden of 7%. Similarly, for engines up to 2.0, the tax goes from 13 to 6.5%, while for cars adapted for alternative fuels, the rate goes from 11 to 5.5%, according to official statements issued by the Ministry.

Likewise, a reduction of the IPI for household appliances was approved for a period of three months that would be fulfilled at the end of June. As reported by the local press, the products benefited belong to the white line, an intensive consumer of paint: thus, refrigerators went from paying 15 to 5% tax, while stoves and stoves will have a complete exemption, large washing machines will go from taxing 20% to 10% and "tanquinhos" or small and digital washing machines will have a tax of 0%.

Finally, a support plan for builders was approved, which aims to repay loans to builders and buyers, as well as the construction of one million social housing. The measure will undoubtedly benefit the architectural segment that is the strongest in Brazil.

"The combination of all these factors leads us to think that there will be a recovery, so we will end the year with 2% down, which is a very good result considering how we did at the end of last year," said Dilson Ferreira.

Current market composition

More than half of the paint market in Brazil corresponds to architectural ones, a segment in which a large number of small companies participate, in addition to the four main ones that, according to Dilson Ferreira, are Basf, Akzo Nobel, Sherwin Williams and PPG.

More than half of the paint market in Brazil corresponds to architectural ones, a segment in which a large number of small companies participate, in addition to the four main ones that, according to Dilson Ferreira, are Basf, Akzo Nobel, Sherwin Williams and PPG."It is worth noting that strong competition from local brands (currently about 600 industries) stimulates competition throughout Brazil, which by its own geography already presents a wide diversity," explained André Niero, of Akzo Nobel.

According to data provided by Abrafati, architectural paintings represent about 77% of the total volume of paintings, and between 59 and 62% of turnover. With the support plan for the sector mentioned above, manufacturers expect consumption to increase

The second most important item corresponds to the industrial segment, in which 15% of the volume is concentrated and between 23 and 25% of business turnover is generated. This includes state-of-the-art paints such as high solids, powder coating and epoxy.

Ferreira explained the current momentum of these segments: "The powder coating market is growing almost twice as fast as industrial liquid paints. The high solids are being widely used in the automotive repainting part, the solvents in the varnishes of the decorative lines are also being replaced."

Automotive repainting stands out in Brazil for generating between 9 and 10% of total turnover, representing 4.5% of the volumes manufactured. Finally, automotive paint for originals (assemblers) generates between 6 and 7.5% of revenues, and between 3.5 and 4.5% of volume. This is despite the fact that in that country some important car manufacturers have a seat that, from there, provide the Latin American market.

Sustainable industry

Brazilians have made important advances in terms of more environmentally friendly production. The work has been directed towards the formulation of paints with lower emission of Volatile Organic Compounds (VOCs) and towards the elimination of some polluting compounds such as lead.

Thus, and with the support of Abrafati, national legislation was recently passed banning the use of lead in architectural paints. Ferreira assures that all the companies that belong to the Association have already adopted the measure. "The rule had a deadline to take effect, in production, until February of this year and gives a period of six more months for stocks in stores to be eliminated, but that is being introduced and will be met," he said.

Regarding the issuance of VOCs, Ferreira said that work is being done by the Association, since there are still no official regulations in this regard: "Abrafati is preparing a self-regulation for its members, so that emissions decrease. The idea is that they will be phased out until Europe's standards are reached. There are several stages, the last one would be in 2014, but gradual improvements would be seen."

The future of the industry aims, then, to have less polluting products and strengthen industrial safety practices in companies, while obtaining a stabilization in the market, which allows companies to think again about growing and investing, as Ferreira assures: "If we end this year growing, the last quarter would be positive compared to last year, 2010 will see positive growth of between 2 and 3%.

Leave your comment