Recent changes in the world economy have changed the share of regional markets on the global scale. Latin America is ahead of this scenario, although it has structural deficiencies that could affect it in the future.

Recent changes in the world economy have changed the share of regional markets on the global scale. Latin America is ahead of this scenario, although it has structural deficiencies that could affect it in the future.

by Latin Press

The effects of the last global crisis that left countless companies bankrupt and destabilized markets have not yet been fully overcome, and a new shadow of doubt is already hanging over European economies.

Greece, Spain and Italy are the main affected in this economic cycle, putting at risk the economic stability of the European Union that, as a bloc, is still debating between a bailout, an incentive plan or even the echo of more radical voices calling for dissolution.

In this scenario, Latin America continues to gain ground as a destination for large investments, having good availability of natural resources, relatively stable government structures and a rapidly recovering economic performance.

In the field of chemistry and commodities in general, the region has seen a growth in investments: the main players in the paint industry are present in the region and the findings of new deposits of titanium dioxide, kaolins and other natural pigments have put our countries in the eye of major investors.

Paint market grows

Volume and turnover estimates have varied in recent years. In 2005 the multinational AkzoNobel estimated the world market at 26,500 million liters of paint and in 2009 the IPPIC said that the figure fluctuated between 26,000 and 28,000 million liters per year.

During 2010 new studies were carried out that indicated that the figure grew. According to AkzoNobel studies, 34.2 billion liters of paint are produced and consumed annually, a figure slightly lower than that of the consultancy James Consulting whose calculations indicate that consumption would be much closer to 35,000 million liters.

To standardize our analysis, we will take as a reference the figure estimated by Louis McCulloch, a consultant specialized in the firm James Consulting, who assures that the world market for paints in 2011 is 34,744 million liters.

During the last version of Abrafati, held in Sao Paulo, Brazil, McCulloch reported that although Latin America is one of the most important destinations for investment in the paints sector, the region that has had the most growth in this area is Asia Pacific, with China at the head.

The Asian share of the paint market amounts to 15,083 million liters per year, which represents 43% of the global total. In America that share is 8,979 million liters; that is, 26% of the total.

The growth of both regions has affected Europe, the Middle East and Africa (EMEA Region), which although it retains the second place in importance with a share of 31%, equivalent to 10,682 million liters; and it is the area with the worst economic outlook today.

A hectic decade

If you look back at the last 10 years based on the statistics presented by James Consulting, the growth of Asia Pacific is overwhelming, a region that went from having 31% of the coatings market in 2001 to 43% in 2010. The reasons are multiple: the population of that area is the one that has grown the most in recent years (10% in India and the subcontinental zone; 7.1% in Southeast Asia; 2.4% in far East Asia and 8% in Oceania), the economic crisis of 2008 and 2009 did not destabilize the economy of the region, investments in industry have grown and the production and transportation costs they offer are the most competitive in the current market.

Meanwhile, in the last decade the share of the Americas, including the Latin region, the United States and Canada, went from 31% to 26% on account of the regional trade dependence that transmitted the symptoms of recession from North America to the center and south of the continent; as well as the slow development of infrastructure in Latin America, particularly in relation to transport.

The European coatings industry has also lost importance. In the last decade it lost 7% of the share of global volume, going from concentrating 38% of the market to only 31%.

Latin America must grow

Three fronts put Latin America at the top of the map of destinations for new investments. In the first place is the relative economic stability offered by most countries, which was demonstrated during the last crisis that also served as a lesson for many of the governments that understood that dependence on trade with the United States is dangerous.

"Latin America suffered with the 2008 crisis, though not as much as Europe and North America. We have already recovered and today we offer investment possibilities to meet regional consumption needs, at least until 2020," said Antonio Carlos de Oliveira, president of the Board of Directors of the Brazilian Association of Paint Manufacturers, Abrafati.

On the other hand, there are new investments in renewable raw materials. In the area of paints, in particular, the region has stood out for researching, developing and producing renewable solvents to replace hydrocarbons with sugarcane and potato derivatives, just to mention two outstanding examples. Similarly, we have worked on the formulation of paints that reduce pollution, do not emit volatile organic compounds and demand fewer resources for their production.

"There is no longer a technological gap between the first world and Latin America. Our countries are investing in research and developments are on par with the rest of the world; even many of our technologies are already being exported," said De Oliveira.

Finally, the population growth of the area suggests an increase in consumption that would be directly proportional to GDP growth. Thus, we have that all the countries of the Latin bloc, including Brazil, add up to more than 400 million people, of which 50% can be economically active; that is, to be a potential consumer.

The presence of the five main groups in the paint industry shows the relevance of the region. For Sherwin Williams, Latin America represents 95% of its market, while in PPG that figure is 50%. To a lesser extent, but with great growth options are DuPont, which invoices 43% of the annual total in the region, AkzoNobel that takes 30% of its profits from the continent and Basf, which sells 28% of the total in the Americas.

Cost Latin America

Despite the good outlook, the precarious development in transport infrastructure means that Latin America's growth can stagnate.

Antonio Carlos de Oliveira, president of the Board of Directors of Abrafati points out that on average the transport of a material or product from China to the Brazilian Amazon takes three days; but from Manaus to the main cities of the country transport takes almost seven days.

This situation is repeated in other countries such as Colombia, where rainy seasons affect the main roads; Peru, where in addition to the Pan-American Highway there are few high-speed highways and Ecuador, where geography complicates development.

The extra cost of local transportation as well as the tax burdens of each country are known as "country cost"; in the regional case "cost Latin America" and, if not adjusted to standards, could bring problems for general development.

To highlight

Brazil remains the leader

Incentives to import basic raw materials for paint production, as well as growth in housing construction and infrastructure investments, make Brazil the country with the highest per capita consumption in the region, with 6.6 liters per year.

The second place is occupied by Argentina, where the architectural segment stands out for its stability and cyclical continuity. Chile and Uruguay have third and fourth place respectively, while Venezuela and Colombia remain below 4.2 liters per capita. (see table).

To highlight

The consumption of architectural products grows

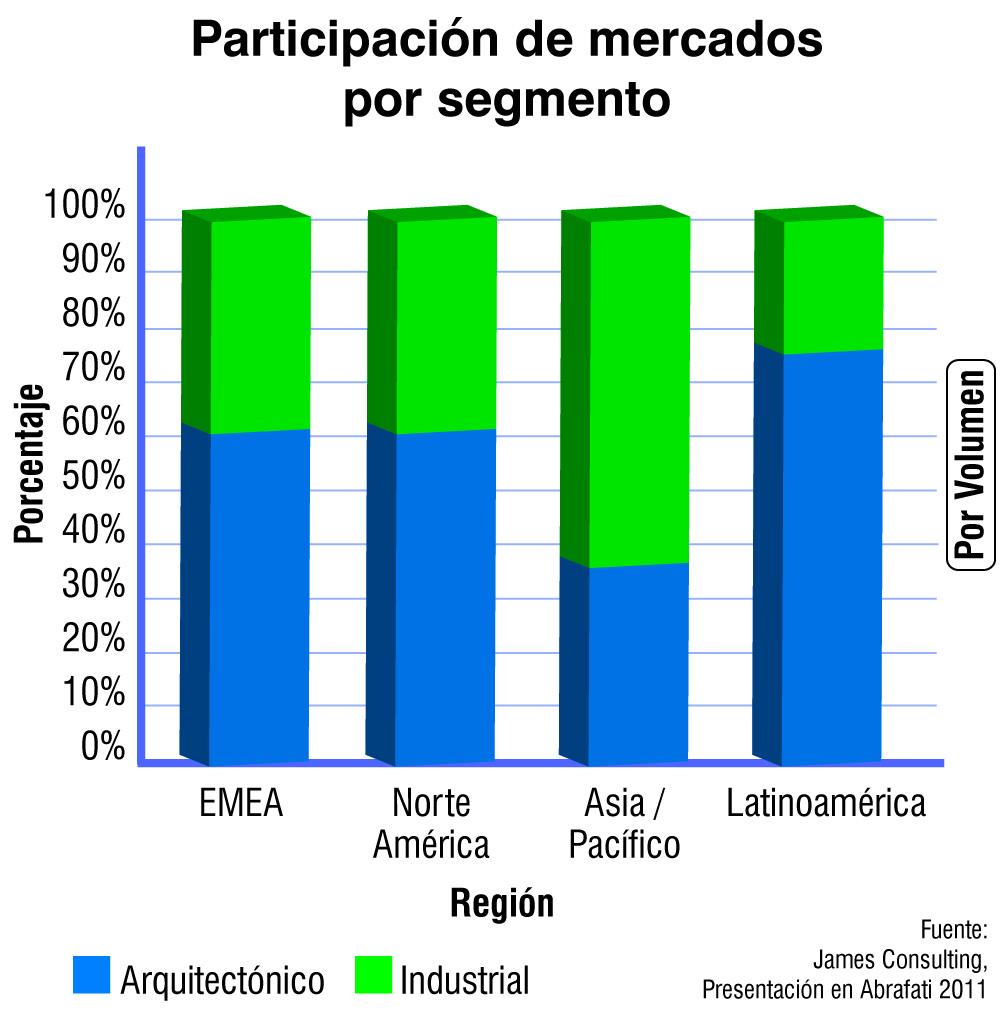

Worldwide, architectural coatings are responsible for 50% of volume consumption. That situation prevails in all regions, except in Asia Pacific, where 35% of sales correspond to coatings for architecture, leaving 65% for the other segments, including architectural, industrial, maritime and aerospace, according to louis McCulloch reports.

Latin America is the region where more architectural paintings are consumed: 75% of the market, which leaves only 25% for the other subsectors. In North America and EMEA the ratio remains at 55 – 45, with a slight advantage of the architectural sector. (See chart).

Leave your comment