The use of titanium dioxide as a base pigment and for the manufacture of other pigments is growing more and more in Latin America, especially due to the entry into force of different international regulations. However, international trade in this product fell during 2009.

by: Vanesa Restrepo

For years titanium dioxide has become the most basic pigment for the paints and coatings industry. Among other things, this white pigment is attributed great benefits such as low toxicity, stability, and ease of dispersion, which make it the most important compound for production worldwide, as far as pigments are concerned.

The variation in its international price has been decisive in the behavior of the paint industry, given that the increases in its prices affect the basic cost structure, being considered one of the raw materials of greater utility and best properties for the production of coatings. These characteristics, together with excellent whiteness, opacity and protective capacity, make titanium dioxide (type IV) ideal for other uses such as the manufacture of plastics, inks, cosmetics, ceramics, white cement and food.

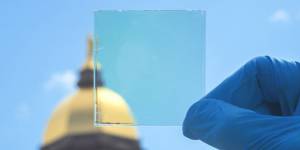

In recent years, with the development of new technologies to improve the performance of coating and enamel formulations, TiO2 has stood out as a material with excellent cost/benefit ratio. This has earned it recognition as one of the most used components in the development of nanotechnologies, especially in self-repairing paints, anti-scratch glasses, self-cleaning coatings, among others.

Today it is the preferred material of "smart" coating developers. Among the most common applications is the use as a mask in the process of generating nanostructures, along with zinc oxide, such as. In combination with light, water, and UV radiation, TiO2 is also used as a photocatalyst to remove the presence of organic materials, including Volatile Organic Compounds, VOCs. This translates into antimicrobial, bactericidal, deodorization and sterilization properties that, in addition, do not generate toxic gases for humans. 1

Recovering market

2010 has brought with it news regarding specific investments in sectors such as construction, infrastructure and aerospace, which have relieved the tension of paint and coating manufacturers, after a year of crisis.

Investment projects throughout Latin America, both public and private, bring with them a direct benefit for this industry, insofar as protection is required for the structures that are built, including houses, hotels, transport systems, ports, sports venues, roads, among others. Thus, it is very likely that in the next two years there will be a growth of the sector, supported by the investment in physical development made by each of the countries.

Raw materials, such as titanium dioxide, will suffer an increase in sales that will be consistent with the aforementioned demand, which will probably lead to a price increase, given that there are no new deposits of rutile, which is the material from which TiO2 (Type IV) is originally extracted. It is pertinent to note that rutile is extracted and then purified with titanium chlorides and reacted with molecular oxygen at a temperature above 1,000ºC.

Consumption in the region

In Latin America, the main rutile reserves are in Brazil, where natural deposits hold an estimated 0.55 million tons of the material. Mataraca, in the state of Paraíba, is the main deposit, from where 80,000 tons of TiO2 are obtained per year, as estimated by the Mineranet portal, in one of its studies.

However, the first exporter of this product in the region is Mexico, as detailed in the reports offered by the specialized portal The Datamyne. Indeed, during the previous year, despite the general fall suffered by the paints and coatings industry, TiO2 exports reached US$176.6 million. This implies an increase of 8.7% compared to the records of 2008, when sales exceeded US$161 million.

The trade balance of titanium dioxide in Mexico presents a surplus of US$34 million, given that imports do not exceed US$143 million. The United States was the main seller (US$132 million), accounting for 93% of titanium dioxide purchases made by Mexican companies.

If we talk about volume, we can say that Mexico sold abroad 116,555 tons of titanium dioxide, 80% of which was distributed between the Belgian, Brazilian and Chinese markets. It is striking that Brazil imports more than US$36 million in this material (second destination of Mexican TiO2 exports), considering that there are no trade agreements between the two countries.

But Mexico was not the main supplier of titanium dioxide to Brazilian industrialists. The reports obtained by INPRA LATINA detail that the Manito country contributed 22% of the material that reached Brazilian soil, but it was the United States that had the largest share, with sales that exceeded US$92 million during 2009.

In total, 96,302 tons of titanium dioxide arrived in Brazil, while the material produced in the country and exported to the neighbors only totaled 599 tons. Thus, the trade balance for this product closed 2009 with a deficit of US$203 million.

Meanwhile, in Argentina, a country that ranks as the third largest manufacturer of paints in Latin America (surpassed by Brazil and Mexico), it imported 18,659 tons of TiO2, worth US$66.5 million in 2009. Compared to 2008, imports fell 12%, while exports went from 131 to 123 tons, with a decrease in value close to 20% (US$-97 thousand). Total imports in 2009 totaled US$370,000.

Broad perspectives

If the statistics of imports and exports of titanium dioxide in the three main Latin American economies are analyzed, as shown in the table "Variation of the consumption of TiO2", it is found that during the crisis the consumption of this product presented significant falls that, in some cases, reached double-digit percentages.

This was the case in Argentina and Brazil, where the volume of internationally traded titanium dioxide fell by 16% and 13%, respectively. Paradoxically, the country that suffered the most from the crisis and whose production of paints and coatings was affected by multiple external factors, including the closure of several automotive assembly plants, was the one that had the least impact on the titanium dioxide trade. In total, the market variation between 2008 and 2009 for the "manitos" was -5.63%.

In spite of everything, the aforementioned investments will favor the dynamization of the paints sector and, incidentally, will increase the demand for TiO2. What is not yet known with certainty is whether there are investment plans to encourage the search and exploitation of rutile or if, on the contrary, rules and incentives will be required to allow the importation of these products without major price variations.

1 Source: http://www.eficy.cl

2021 hasta noviembre

35.550.705kg

Cif us109.571.635

Us 3082 x ton.

Fuente Indec.